In this blog post, we will explore the captivating history of the petrodollar, its impact on various countries, and delve into some additional insights. Keep reading!

The Birth of the Petrodollar

The origin of the petrodollar can be traced back to the Bretton Woods system, established in 1944, which pegged the value of many currencies to the U.S. dollar. However, it was the oil crisis of the 1970s that catalyzed its ascent.

As a response to the Arab-Israeli War, OPEC countries implemented an embargo on oil exports to countries supporting Israel, leading to a significant increase in oil prices.

Facing the economic strain caused by rising oil prices and the diminishing value of the U.S. dollar due to inflation, President Richard Nixon took a historic step by abandoning the gold standard in 1971. This decision severed the direct convertibility of the U.S. dollar to gold, shifting the global monetary system towards a fiat currency regime.

Petrodollar Countries: A Global Financial Nexus

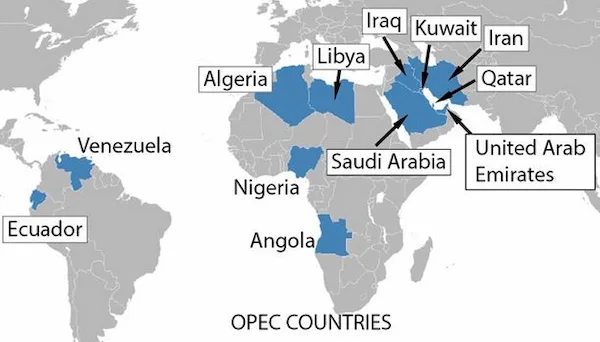

Explore with us as we navigate the list of petrodollar countries, nations that play a crucial role in this intricate dance of economics. These countries not only supply the world with vital energy resources but also contribute to the resilience and dominance of the U.S. dollar in international trade.

Here is a list of key petrodollar countries along with brief explanations of their roles in the petrodollar system:

- Saudi Arabia:

- As one of the world’s leading oil producers, Saudi Arabia is a linchpin in the system. The kingdom’s decision to price its oil exclusively in U.S. dollars established the petrodollar framework.

- United Arab Emirates (UAE):

- The UAE, particularly through Dubai, has emerged as a significant player in the system. Vast oil reserves and strategic geographic positioning have allowed the UAE to leverage its economic strength in international trade and finance.

- Russia:

- Despite not being an OPEC member, Russia is a major oil-producing nation with significant influence it. Its stance on pricing oil in dollars and geopolitical role in global energy markets contribute to its status as a petrodollar country.

- Iran:

- Iran, with substantial oil reserves, has historically participated in the petrodollar system. However, geopolitical tensions and international sanctions have led Iran to explore alternative payment mechanisms, challenging the traditional framework.

- Venezuela:

- Possessing some of the world’s largest oil reserves, Venezuela has faced challenges within the petrodollar system. Economic turmoil, political instability, and fluctuating oil prices have prompted shifts in the country’s relationship with the U.S. dollar.

The Petrodollar System:

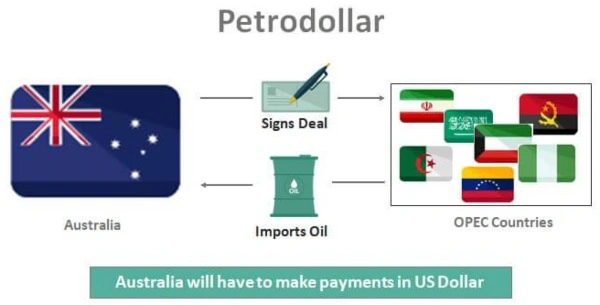

To mitigate the impact of losing the gold standard, the United States negotiated with Saudi Arabia and other OPEC members to price oil exclusively in U.S. dollars. In return, the U.S. committed to ensuring the stability and security of the regional oil-producing countries, prompting other countries to follow suit.

Impacts on Countries:

- United States: The petrodollar system provided a tremendous advantage to the U.S., as it allowed for the increased demand and circulation of U.S. dollars worldwide, strengthening its influence and the status of the U.S. as a global economic power.

- Oil-Producing Countries: Nations with substantial oil reserves, such as Saudi Arabia, Kuwait, and the UAE, benefited immensely from the petrodollar system. They witnessed significant economic growth and wealth accumulation, fueled by oil revenues denominated in a stable, widely accepted currency.

- Non-Oil Producing Countries: Non-oil producing countries became reliant for their oil imports, implementing policies to maintain favorable relations with oil-producing countries and ensure the stability of their domestic economies.

Challenges and Shifting Dynamics:

- Petrodollar Recycling: As oil-producing nations amassed significant wealth, they began to invest their surplus dollars in international financial markets, paving the way for petrodollar recycling and the emergence of sovereign wealth funds.

- Geopolitical Consequences: It has influenced geopolitical dynamics, with the U.S. maintaining close ties with oil-rich countries to ensure its economic stability and source of oil.

- Potential Disruptions: In recent years, countries and interest groups have expressed concerns over the dominance of the system. Some alternative initiatives, such as the use of other currencies for oil transactions, have gained attention as potential disruptors.

Tracing the History of the Petrodollar

To understand the present, we must journey into the past. Uncover the historical context that led to the establishment of the petrodollar system, from the Bretton Woods Agreement to the geopolitical shifts that shaped the modern financial landscape.

The history of the petrodollar dates back to the 1970s and is closely tied to the geopolitics of oil and global economic dynamics:

- Oil Price Shocks (1970s): The foundation of the petrodollar system was laid during the oil crises of the 1970s. OPEC, comprised of major oil-producing nations, responded to geopolitical events by asserting control over their oil resources, leading to a significant increase in oil prices.

- Formation of OPEC: OPEC, formed in the early 1960s, gained prominence in the 1970s as a powerful cartel. During the Yom Kippur War in 1973, OPEC nations imposed an oil embargo, leading to a quadrupling of oil prices and triggering a major shift in the global economic landscape.

- Surge in Dollar Reserves: As oil prices skyrocketed, oil-exporting nations, especially those in the Middle East, began accumulating substantial reserves in U.S. dollars. The massive inflow of dollars resulted from the fact that oil transactions were predominantly priced and traded in U.S. currency.

- Bilateral Agreements with the U.S.: To ensure the stability of oil supplies and the continuous use of the U.S. dollar, the United States entered into bilateral agreements with key OPEC members, particularly Saudi Arabia. These agreements cemented it, requiring OPEC nations to price and sell oil exclusively in U.S. dollars.

- Dollar as the Global Reserve Currency: The petrodollar system played a crucial role in solidifying the U.S. dollar as the world’s primary reserve currency. The constant demand for dollars in international oil transactions contributed to its widespread use in global trade and finance.

- Economic and Geopolitical Influence: It provided the United States with significant economic and geopolitical advantages. It allowed the U.S. to finance its trade deficits, maintain low-interest rates, and wield influence over global financial institutions.

- Challenges and Adaptations: Over the years, challenges emerged as some nations sought alternatives to the U.S. dollar in energy transactions. Geopolitical tensions, economic shifts, and the exploration of non-dollar payment mechanisms, especially by countries like Iran, introduced complexities to the traditional framework.

- Contemporary Dynamics: In the contemporary era, It remains a central aspect of global finance. Ongoing changes in energy dynamics, the emergence of alternative energy sources, and discussions about de-dollarization contribute to ongoing debates about the future.

Impact and Implications

The petrodollar system isn’t just an economic arrangement; it’s a force that reverberates globally. Explore the impact and implications of this financial framework on currency values, international relations, and the geopolitical chessboard. How does the petrodollar system influence the ebb and flow of the global economy?

Conclusion and reflection:

In conclusion, the petrodollar system isn’t merely a topic of economic discourse; it’s a critical component woven into the fabric of global finance.

By understanding its history, agreements, and the countries involved, we gain valuable insights into the mechanisms shaping our financial reality. Stay tuned for more explorations into the intricate intersections of money, geopolitics, and the ever-evolving petrodollar system.