Find out all about the world’s least valuable currency: top 5, why it is worth less than the rest and much more. Keep reading!

What is the Weakest Currency and Why?

Do you know which currency is the weakest in the world? It’s the Iranian Rial (IRR), the official currency of Iran. Currently, it has an exchange rate of 514,000 IRR to 1 USD, which means that you need a lot of IRR to buy even basic goods.

The decline of the Iranian Rial’s value has been going on for years, and its inflation rate has been consistently high. In the 1970s, it was worth around 70 US cents, but now it’s worth a lot less.

The reasons behind its weakness are complex and include international sanctions, political instability, and the country’s reliance on oil exports.

TOP 5 Currencies with Low Value

- Iranian Rial (IRR): 514,000 IRR to 1 USD

- Vietnamese Dong (VND): 23,000 to 1 USD

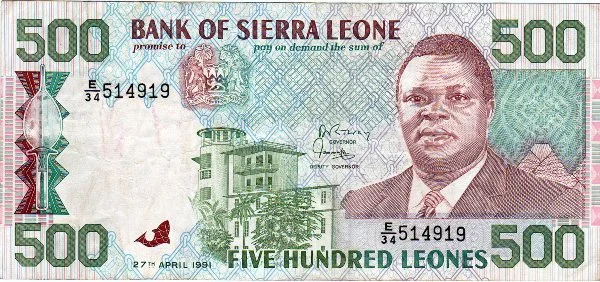

- Sierra Leonean Leone (SLL): 22,000 to 1 USD

- Laotian Kip (LAK): 17,000 to 1 USD

- Indonesian Rupiah (IDR): 15,000 IDR to 1 dollar

Note that currency values can fluctuate over time, so these numbers may not remain the same in the future.

There are several other currencies besides the Iranian Rial that have lost value in recent years. The decline in value of these currencies is due to factors such as inflation, political instability, and economic turmoil.

Understanding the Factors that Weaken a Currency

Have you ever wondered why some currencies are weaker than others? There are several factors that contribute to a currency’s decline in value. One of the primary factors is inflation, which happens when the supply of money is more than the demand for goods and services. This results in a decrease in the currency’s purchasing power, which, in turn, lowers its value.

Another reason for currency weakness is political instability and economic turmoil. When a country faces civil unrest or economic instability, investors lose confidence in its economy, which can lead to a decrease in demand for its currency. This, in turn, reduces the currency’s value.

Additionally, global events such as economic sanctions, natural disasters, and changes in international trade policies can impact a currency’s value. A country’s debt levels, balance of payments, and interest rates also play a role in its currency’s strength.

Understanding the factors that contribute to a currency’s weakness is crucial for investors, travelers, and businesses looking to trade internationally. Keeping an eye on the economic and political conditions in different countries can help you make informed decisions and avoid potential risks.

Is Investing in Weak Currencies a Good Idea?

Investing in the weakest currencies can be tempting for some investors, as they may see an opportunity to make a profit from fluctuations in value. However, it is important to keep in mind that investing in weak currencies can be risky. The value of these currencies can fluctuate significantly over time, which can result in significant losses.

Forex trading is one way to invest in currencies based on their current value. However, it’s important to do thorough research and consult with a financial advisor before investing in any currency, particularly those with low value. It is also essential to have a clear understanding of the risks involved and to have a solid investment strategy in place.

Investing in weak currencies can provide valuable insight into global economics and financial markets. Make informed decisions based on thorough research and expert advice.

Discover the most expensive currency in the world in this article.