Hey there! Have you heard about central bank digital currency (CBDC)? It’s a new buzzword in the world of finance and economics. In this article, we’ll dive into what CBDC is, when it’s being launched, and the countries that have already implemented it.

What’s the meaning of CBDC?

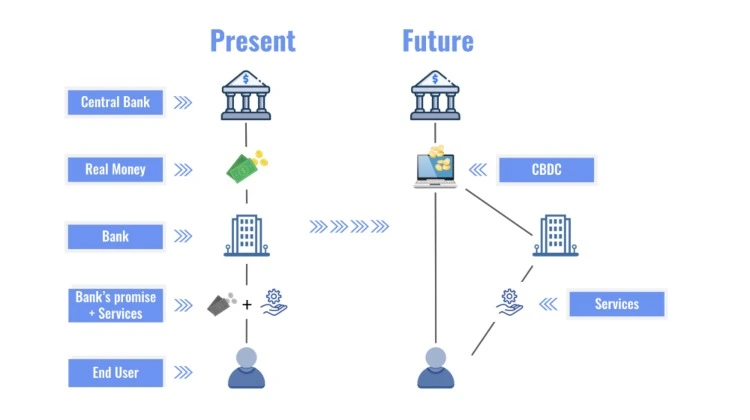

In simple terms, CBDC is a digital currency that is issued and regulated by a country’s central bank.

It’s like digital cash that can be used to make payments, transfer funds, and store value. Unlike cryptocurrencies like Bitcoin, CBDC is regulated by the government.

The meaning of CBDC is pretty straightforward – it’s a digital version of a country’s fiat currency. Fiat currency is physical money, like dollars or euros, that is backed by the government. CBDC is just a digital version of this physical cash.

When are countries launching CBDCs?

China’s been developing its CBDC, called the Digital Currency Electronic Payment (DCEP), since 2014 and is currently testing it in various regions.

Sweden’s central bank is also testing a digital version of the Swedish krona, called the e-krona. The Bahamas launched the Sand Dollar in 2020, becoming the first country in the world to issue a CBDC.

Other countries like the US, Canada, Japan, and the European Union are also exploring the possibility of launching their own CBDCs.

What countries already have CBDCs?

The Bahamas was the first country to launch a CBDC with the Sand Dollar. The digital currency is being used in the country’s Family Islands and is expected to roll out nationwide soon.

China’s DCEP is also in advanced stages of development and has already been tested in several cities. Other countries like Sweden, South Korea, and Singapore are in the testing phases of their own CBDCs.

Reflection

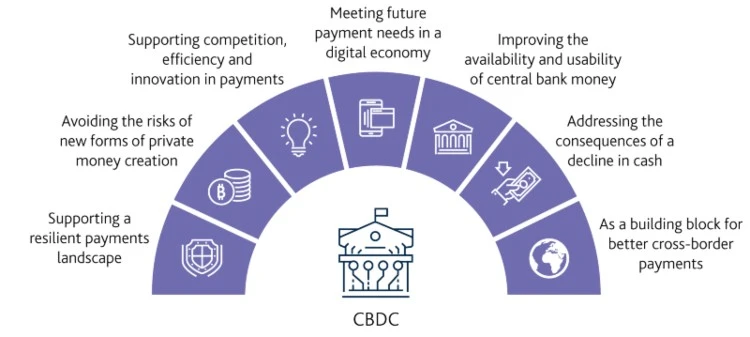

In conclusion, CBDC is a new and exciting development in the world of finance and economics. As more and more countries explore the possibility of launching their own CBDCs, it will be interesting to see how it affects the traditional banking system and the global economy as a whole.

So, keep an eye out for the latest developments in CBDC, as it has the potential to change the way we use and think about money!